- HP 10BII FINANCIAL CALCULATOR APP HOW TO

- HP 10BII FINANCIAL CALCULATOR APP SERIES

- HP 10BII FINANCIAL CALCULATOR APP FREE

Solving for the IRR is done exactly the same way, except that the discount rate is not necessary because that is the variable for which we are solving.

For the NPV we must supply a discount rate, so enter 12 into I/YR and then press Shift PRC (note that below the PRC key is NPV in orange). To find the NPV or IRR, first clear the financial keys and then enter -800 into CF j, then enter the remaining cash flows exactly as before. Generally speaking, you'll pay for an investment before you can receive its benefits so the cost (initial outlay) is said to occur at time period 0 (i.e., today). To solve this problem we must not only tell the calculator about the annual cash flows, but also the cost. Suppose that you were offered the investment in Example 3 at a cost of $800. Pretty easy, huh? (Ok, at least its easier than adding up the future values of each of the individual cash flows.) Example 4 - Net Present Value (NPV)Ĭalculating the net present value (NPV) and/or internal rate of return (IRR) is virtually identical to finding the present value of an uneven cash flow stream as we did in Example 3. Now press FV and you'll see that the future value is $1,762.65753. Clear the financial keys ( Shift C) then enter -1000.17922 into PV. In this case, we've already determined that the present value is $1,000.17922. Next, find the future value of that present value and you have your solution. Realize that one way to find the future value of any set of cash flows is to first find the present value. There is no key to do this so we need to use a little ingenuity. Now suppose that we wanted to find the future value of these cash flows instead of the present value. Example 3.1 - Future Value of Uneven Cash Flows

We find that the present value is $1,000.17922. Now, enter 12 into I/YR and then press Shift NPV. Now, press 0 CF j, 100 CF j, 200 CF j, 300 CF j, 400 CF j, and finally 500 CF j. All we need to do is enter the cash flows exactly as shown in the table. Instead, we'll use the cash flow key ( CF j). We could solve this problem by finding the present value of each of these cash flows individually and then summing the results. How much would you be willing to pay for this investment if your required rate of return is 12% per year? Suppose that you are offered an investment which will pay the following cash flows at the end of each of the next five years: Period

HP 10BII FINANCIAL CALCULATOR APP SERIES

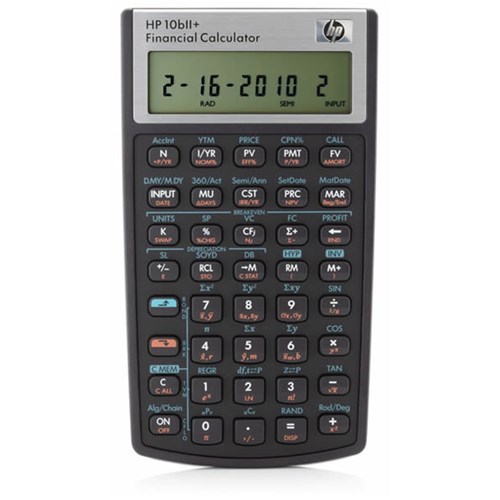

In addition to the previously mentioned financial keys, the 10BII also has a key labeled CF j to handle a series of uneven cash flows. Example 3 - Present Value of Uneven Cash Flows

HP 10BII FINANCIAL CALCULATOR APP HOW TO

We will also see how to calculate net present value (NPV), internal rate of return (IRR), and the modified internal rate of return (MIRR). In this section we will take a look at how to use the HP 10BII to calculate the present and future values of uneven cash flow streams. In the previous section we looked at the basic time value of money keys and how to use them to calculate present and future value of lump sums and regular annuities.

HP 10BII FINANCIAL CALCULATOR APP FREE

Are you a student? Did you know that Amazon is offering 6 months of Amazon Prime - free two-day shipping, free movies, and other benefits - to students? Click here to learn more

0 kommentar(er)

0 kommentar(er)